Every workplace that has employees needs someone to take care of the payroll. As a Payroll Compliance Professional (PCP) you’ll have the skills to ensure it’s done right.

There are three separate courses in the program, and you’ll need to register for each separately

Want to know more?

Attend the Payroll Compliance Professional information session

Learn everything you need to know about the Payroll Compliance Professional (PCP) certification—from eligibility requirements to career benefits.This session will cover certification details, compliance best practices, and answer your questions about building a successful payroll career. Don’t miss this opportunity to get expert insights and guidance!

Date: February 18, 2026

Time: 6 pm to 7 pm

Format: Virtual via MS Teams

Sign up for Payroll Compliance Professional info session

Payroll Professional courses

This is the first core payroll course in the Payroll Compliance Professional (PCP)

Course details

Spring 2026 Delivery

Course Code: MGPC 001 | Section Code: S26W70

Dates: Mar. 3 to Apr. 23, 2026 | Tuesday and Thursdays | Duration: 8 weeks

Times: 5:45 pm to 9:00 pm

Exam schedule: Mar. 24, 2026 (Mid-term), Apr. 23, 2026 (Final)

Delivery: Online, synchronous

Fees: $550 + GST

Fall 2026 Delivery (Registration opens May 1, 2026)

Course Code: MGPC 001 | Section Code: F26W70

Dates: Sep. 15 to Nov. 5, 2026 | Tuesdays and Thursdays | No Classes Oct. 1 & Nov. 3

Times: 5:45 pm to 9:00 pm

Exam schedule: October 6, 2026 (Mid-term), November 5, 2026 (Final)

Delivery: Online, synchronous

Fees: $550 + GST

This is the second core payroll course in the Payroll Compliance Professional (PCP) designation program.

Course topics

When you complete this course, you will be able to:

- calculate regular individual pay

- calculate non-regular individual pay

- calculate termination payments

- complete a Record of Employment (ROE)

- communicate all aspects of individual pay requirements to stakeholders.

Course details

Summer 2026 Delivery (Registration open January 2, 2026)

Course Code: MGPF 001 | Section Code: I26W70

Dates: May 5 to June 18, 2026 | Tuesdays and Thursdays | Duration: 6 weeks

Times: 5:45 pm to 9:00 pm

Exam Schedule: May 26, 2026 (Mid-term); June 18, 2026 (Final exam)

Delivery: Online, synchronous

Fees: $550 + GST

Fall 2026 Delivery (Registration opens May 1, 2026)

Course Code: MGPF 001 | Section Code: F26W70

Dates: September 1 to October 15, 2026 | Tuesdays and Thursdays | Duration: 6 weeks

Times: 5:45 pm to 9:00 pm

Exam Schedule: September 22, 2026 (Mid-term); October 13, 2026 (Final exam)

Delivery: Online, synchronous

Fees: $550 + GST

Register for Payroll Fundamentals 1

This is the final core payroll course in the Payroll Compliance Professional (PCP) program.

Course topics

When you complete this course you will be able to:

- calculate organizational remittances to federal, provincial and third party stakeholders

- prepare accounting documentation for payroll

- complete year-end documentation

- communicate all aspects of organizational remittances, accounting, and year-end requirements of internal, external and government stakeholders.

Course details

Fall 2026 Delivery Schedule (Registration open May 1, 2026)

Course Code: MGPF 002 | Section Code: F26W70

Dates: October 27 to December 10, 2026

Times: 5:45 pm to 9 pm; Tues. & Thur.

Exam Schedule: November 17, 2026 (Mid-term); December 10, 2025 (Final exam)

Delivery: Online, synchronous

Fees: $550 + GST

Steps to becoming a Payroll Compliance Professional

The first step in becoming a payroll professional is to register for a payroll course at Vancouver Island University. You can register for each course individually by clicking the Course Registration button located within each course listing above.

There are no prerequisites for the first course, however, course must be taken in order as each course is a pre-requisite for the next one.

.

Please note: A minimum grade of 65% on the final exam and 65% overall is required to successfully complete each course.

In addition to completing the three payroll courses, you must complete an approved introductory accounting course.

Vancouver Island offers two approved accounting courses in the Faculty of Management.

- ACCT 101 Accounting for Non-Financial Managers

- ACCT 100 Financial Accounting I

- GCIB 504 Foundations of Financial Accounting

Check the Generate Timetable to determine when accounting courses are available. You must apply to be admitted to the course as non-regular students.

Contact the Koren Bear, Program Coordinator for more information on how to apply for an accounting course at VIU, Email; koren.bear@viu.ca.

You may also take an accounting course at another approved institution. Check the list of NPI approved accounting courses. If you have already taken an introductory accounting course you can use it as your accounting course by completing a transfer credit application.

The National Payroll Institute has a dual registration process. This means in addition to paying VIU tuition for the course, you must also register with the Institute and pay their registration fee for each course. You must also register for a 1-year "candidate" membership fee to receive access to the learning platform. You will pay the membership fee the first time you enroll in a course.

You should register with the Institution no later than ten business days before the start date of the course to access to the online learning platform. For all registrations processed by the deadline described above, you will be granted access to the learning platform 1-2 business days prior to the course start date. All course materials will be accessed through the online platform. You can choose to purchase hardcopies of the manuals directly from National Payroll Institue for an additional cost.

You can register with the Institute two ways:

- Download the course registration form from the National Payroll Institute, under Payroll Education/ Payroll Designations / Designation Forms / Scroll down to PCP Classroom / Click on PCP Classroom General - Part-time. Students enrolled at VIU shall be considered part-time students with the National Payroll Institute. Please download and fill in the part-time form application for each course.

- You can also enroll directly on the Institute's website by going to Payroll Education/ Payroll Designations / Scroll down to Payroll Compliance Practitioner / Click on Register / Click on the name of the course you are registering for (eg; Payroll Fundamentals 1) / Scroll down to the course associated with Vancouver Island University. Click on Register and then click on Register Myself and pay with your credit card.

Complete one year of weighted experience.

To obtain your Payroll Compliance Professional (PCP) designation you must complete a minimum of one year of weighted payroll work experience. You will fill out a Work Experience Requirement Application (WERA).

Note: You have five years to complete all the certification requirements to obtain your Payroll Compliance Professional designation.

Instructors

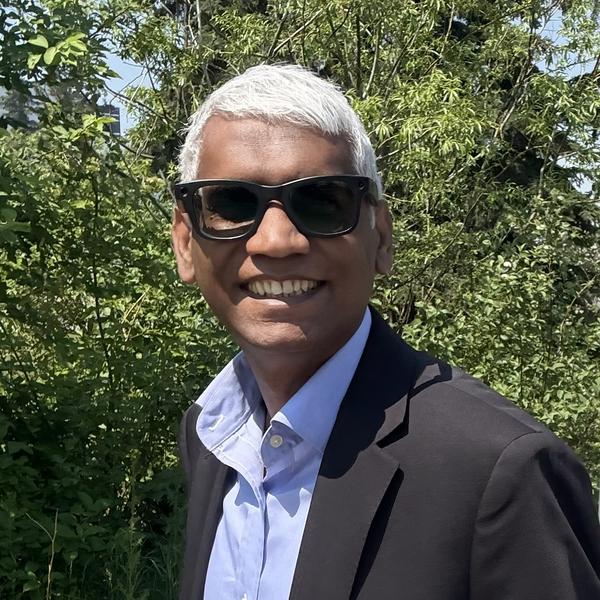

Muhammad Quasem, PCP, CPA

Muhammad is a seasoned auditing and accounting professional with over 17 years of experience in public sector financial oversight. He began his auditing career at the Canada Revenue Agency, serving four years as an Income Tax Auditor, where he developed expertise in compliance, risk assessment, and investigative auditing. Since 2012, he has worked as a Premium Auditor with the Workers’ Compensation Board (WCB) Alberta, specializing in payroll and premium audits to ensure accuracy, fairness, and compliance for Alberta employers.

Muhammad is deeply passionate about education and knowledge-sharing. Muhammad holds degrees from the University of North Texas and McGill University. He is a Chartered Professional Accountant (CPA) and a Payroll Compliance Practitioner (PCP). He has been teaching at Bow Valley College since 2018 and has recently joined Vancouver Island University Professional Development and Training Department to instruct payroll. Muhammed loves inspiring learners about accounting, payroll and taxation.

Samantha Santoro, PCP

For 20 years I provided payroll processing services in the construction industry part-time while teaching health care programs at the post secondary level. Seven years ago, I left health care instruction to focus on payroll exclusively. I have since received my Payroll Compliance Professional (PCP) designation with the National Payroll Institute. I have had the pleasure of specializing in payroll in the construction, transportation, and retail sectors. I have a keen interest in payroll compliance and legislation and believe strongly that payroll being completed accurately and on time is vital to business health. In my off time, I enjoy spending time with my husband and children out on the water and have a genuine love of cooking and nutrition.

Jing Fei Feng, PLP

Jing Fei Feng is a payroll professional with over 16 years of experience spanning municipal government, higher education, oil sands company, and both unionized and non-unionized environments. She specializes in payroll compliance, process optimization, and team leadership, with a proven track record in managing complex pay environments. Passionate about bridging payroll theory with real-world practice, Jing Fei is dedicated to helping students develop the technical expertise and professional judgment needed to excel in the field.

Leslie Albright, PCL, PLP

Driven by a strong work ethic and a passion for operational excellence, I help organizations streamline payroll processes while fostering a collaborative environment where learning and open communication thrive.

Leslie received her payroll designations from the National Payroll Institute (PLP, PCP), and has a Diploma in General Accounting from Mount Royal University and a Diploma in Project Management from the Athabasca University.

Payroll Compliance Professional

Vancouver Island University is an approved delivery agent for National Payroll Institute's Payroll Compliance Professional Program courses. Information on the steps to becoming a designated Payroll Compliance Practitioner, please click on the link below.

Questions?

For more information visit the National Payroll Institute, or email the Accreditation Department at accreditation@payroll.ca.

Program Contact: Koren Bear, Program Coordinator, Professional Development and Training (Faculty of Management)

Email: Koren.Bear@viu.ca